Find The Perfect VAT Consultant

For Your Business

Are you a business owner in Dubai struggling to stay compliant with the complex VAT regulations? If so, hiring a professional Dubai VAT consultant can be the game-changer you need. At Sarah Ferguson we can help you navigate the intricacies of VAT registration, compliance, and refunds, ultimately saving you time, money, and stress.

Understanding the Role of VAT Consultants in Dubai

VAT consultants in Dubai play a crucial role in helping businesses adhere to the UAE VAT law and regulations, which can be complex and challenging

to navigate. At Sarah Ferguson VAT Consultancy we offer a wide range of VAT services, including:

Consulting

Registration

Training

Return

Guidance on

UAE VAT law

and regulations

By understanding the role of VAT consultants in Dubai, businesses can ensure compliance with tax regulations and efficient tax planning, ultimately leading to the smooth

functioning of their operations. Engaging VAT consultants from Sarah Ferguson, can significantly influence business operations by ensuring proper management of output

VAT, minimizing the risk and complexity of transactions, and improving overall efficiency. Their expertise in VAT compliance and advisory services can help businesses avoid

costly penalties while maintaining accurate financial records, making them an invaluable asset in the ever-evolving landscape of UAE tax laws.

Responsibilities of a VAT Consultant

VAT consultants in Dubai are responsible for:

- Providing expert advice

- Managing VAT registration

- Ensuring compliance with UAE tax regulations

- Guaranteeing adherence to UAE VAT laws and regulations

- Helping businesses claim VAT refunds when possible

- Providing guidance on tax planning and compliance

Professionals at Sarah Ferguson VAT Consultancy can assist with these services.

VAT verification, which can be achieved by engaging the best VAT consultancy services, offers several benefits for businesses, including:

- A strong standing among internal and external stakeholders.

- Increased credibility due to a lack of involvement in tax evasion practices.

- Adoption of proper tax procedures.

- Maintenance of accurate financial records.

- Contribution to success and growth in the competitive Dubai market.

By hiring a VAT consultant, businesses can ensure that they are following the necessary procedures and positioning themselves for success.

Benefits of Hiring a

VAT Consultant from Sarah Ferguson

Companies can benefit from improved audit reports and finance processes, specialist tax advice, help with VAT filings and compliance, and the avoidance of VAT penalties. In addition, the services of a VAT consultant can contribute to an increase in cash flow and the generation of desired revenue for the business, making their expertise invaluable in the competitive Dubai market.

We provide the following services:

-

Tailored VAT advisory services to meet the needs of each client

-

Guidance to help businesses achieve their goals and stay compliant with tax laws

-

Assistance in optimizing tax strategy and minimizing liabilities

-

Support in preventing costly penalties

Their experienced professionals make them a top choice for businesses seeking comprehensive VAT consultancy services in Dubai.

Eligibility Criteria for VAT Registration

The mandatory registration threshold for Value Added Tax (VAT) in Dubai is AED 375,000. Businesses with taxable supplies and imports above this

threshold must register for VAT. However, businesses with a taxable supply and import amount between AED 187,500 and AED 375,000 may register

for VAT voluntarily. This provides an opportunity for smaller businesses that do not exceed the mandatory threshold to still benefit from the VAT system.

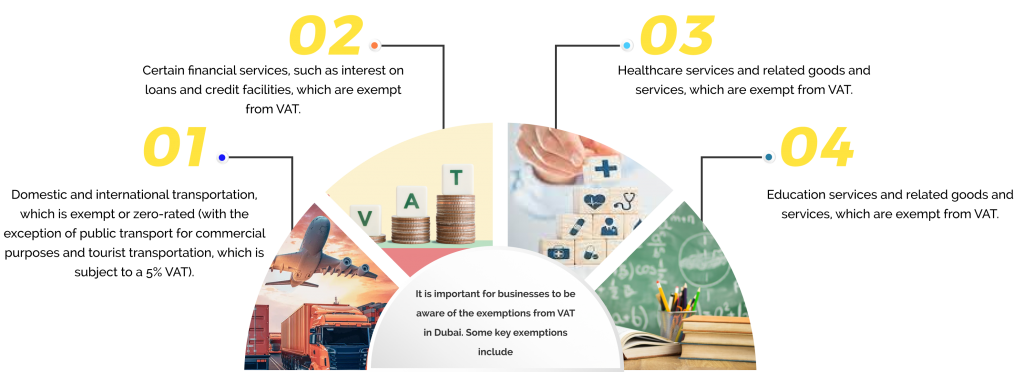

Understanding these exemptions is crucial for businesses to accurately calculate their taxable supplies and determine if they are required to register for VAT.

Required Documents for VAT Registration

For VAT registration in Dubai, businesses must submit the requisite documentation, including copies of the trade license, passports of owners/shareholders/managers, and financial records. The trade license is necessary to demonstrate that the business is legally registered in Dubai, while the passport copies and Emirates ID are imperative to verify the identity of the owners/shareholders/managers of the business. Financial records are essential to demonstrate the financial stability of the business.

We provide the following services:

-

Obtaining a trade license from the Department of Economic Development

-

Acquiring passport copies and Emirates ID from the pertinent authorities

-

Obtaining financial records from the business

Being well-prepared with the required documents can help expedite the VAT registration process and ensure a smooth experience for the business

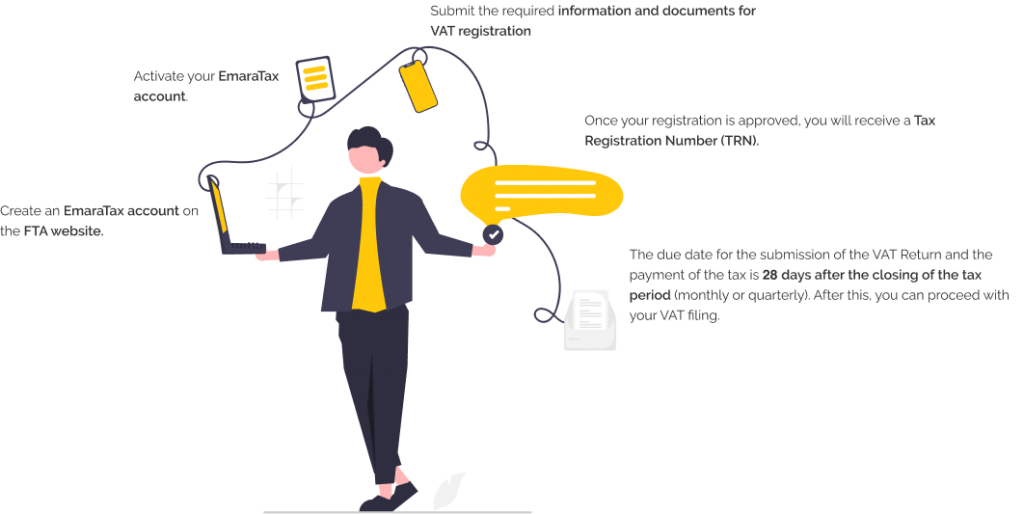

The Registration Process and Timeline

The registration process for VAT in Dubai can be completed through the Federal Tax Authority’s (FTA)

website by following these steps:

Comprehensive VAT Consultancy

Services in Dubai

Comprehensive VAT consultancy services in Dubai, offered by Sarah Ferguson, can help businesses maintain compliance with tax regulations, file VAT returns, and receive refunds when applicable. These services are essential for businesses operating in Dubai, as they ensure a seamless experience for businesses navigating the complex VAT system, ultimately leading to increased efficiency and profitability.

In order to provide the best possible VAT consultancy services, VAT consultants must possess a wide range of expertise, including finance, IT, operations, VAT computation, and local tax laws.

The various aspects of comprehensive VAT consultancy services offered by Sarah Ferguson VAT Consultancy, including VAT compliance and advisory services, VAT return filing and refunds, and training and support, demonstrating how these services can benefit businesses in Dubai.

VAT Compliance and Advisory Services

VAT compliance and advisory services are essential for businesses in Dubai, as they ensure adherence to tax laws and regulations. These services can

help businesses prevent costly penalties and maintain accurate financial records, making them an invaluable asset in the ever-evolving landscape of

UAE tax laws.

Sarah Ferguson Tax Consultancy provides comprehensive VAT compliance and advisory services, tailored to the specific needs of each client. By

engaging a VAT consultant from Sarah Ferguson, businesses can optimize their time and resources while also receiving specialized knowledge and

guidance on VAT compliance and regulations, as well as staying up-to-date with the federal tax authority requirements.

Their expertise in this area ensures that businesses:

Remain compliant

with tax laws

Avoid penalties

Maintain accurate

financial records

Ultimately contribute to their

success and in the

competitive Dubai market.

Training and support services for VAT can provide businesses with knowledge of VAT regulations and optimal procedures. These services can facilitate businesses’ comprehension of VAT regulations, ensure adherence to the most recent regulations, and provide advice on optimal practices. Sarah Ferguson VAT Consultancy offers a variety of training and support services, including one-on-one consultations, seminars, workshops, and online courses.

By participating in training and support services offered by Sarah Ferguson VAT Consultancy, businesses can stay up-to-date on the latest VAT regulations and best practices, ultimately improving their overall compliance with tax laws and enhancing their financial performance. These services can be invaluable in helping businesses navigate the complex VAT system in Dubai and ensure continued success in the competitive market.

VAT return filing and refunds assistance, including vat refund, is a crucial service offered by VAT consultants. It enables businesses to

These services are particularly beneficial for businesses that frequently engage in transactions involving VAT. Sarah Ferguson VAT Consultancy offers expert assistance with VAT return filing and refunds, helping businesses accurately calculate their input and output VAT, file their returns on time, and claim any applicable refunds. By engaging a VAT consultant for these services, businesses can optimize their tax strategy, minimize liabilities, and ultimately improve their overall financial performance.

At Sarah Ferguson VAT Consultancy, we understand that every business has unique needs. That's why our pricing and service packages are not only competitive but also tailored to your specific business requirements. We ensure you get the precise guidance and support you need without the burden of unnecessary costs.

When you compare our offerings with other VAT consultants, we're confident you'll recognize the unparalleled value we bring to the table. Investing in our services will empower your business to streamline its tax strategy, minimize liabilities, and enhance overall financial performance.

Don’t let complex VAT regulations hold your business back. By engaging a VAT consultant from Sarah Ferguson VAT Consultancy, you can unlock the potential of your business and ensure its continued growth and success. Take the first step towards a more efficient and compliant future by investing in the expertise of a professional VAT consultant today.

When selecting a VAT consultant in Dubai from Sarah Ferguson, businesses should evaluate the consultant’s experience and proficiency, review client testimonials and reviews, and compare pricing and service packages. These factors can help businesses make an informed decision when choosing a VAT consultant, ultimately ensuring that they receive the best possible service and support for their specific needs.

Experience and Expertise

Experience and expertise in the following areas are essential for effective VAT consultancy:

Finance

Finance IT

IT Operations

Operations Local tax laws

Local tax laws

Sarah Ferguson VAT Consultancy is managed by Sarah Ferguson, a Chartered Tax Consultant with over 16 years of experience in the industry, and provides VAT and Tax services to businesses in Dubai.

Their expertise in areas such as:

- financial planning

- budgeting

- forecasting

- financial analysis

- tax planning

- compliance

ensures that businesses receive the best possible guidance and support when navigating the complex VAT system in Dubai.

By choosing a VAT consultant with the right experience and expertise, businesses can be confident that they are receiving the best possible advice and guidance, ultimately leading to improved compliance and financial performance.

Client Testimonials and Reviews

At Sarah Ferguson VAT Consultancy, we believe in the value of our clients’ feedback. Their testimonials and reviews serve as an

impartial testament to the quality of service we deliver. As you consider partnering with us, we invite you to explore the experiences

of businesses that have entrusted us with their VAT needs. Their insights will give you a firsthand view of the unparalleled service

and support we consistently provide.

FAQs

What services do VAT consultants in Dubai provide?

VAT consultants in Dubai provide advisory, compliance, registration, training, returns, and guidance services related to UAE VAT law and regulations.

These services help businesses understand and comply with the UAE VAT law and regulations, ensuring that they are compliant with the law and can take advantage of the benefits of the VAT system.

The consultants also provide guidance on the subject.

What are the eligibility criteria for VAT registration in Dubai?

Businesses with taxable supplies and imports above AED 375,000 must register for VAT in Dubai, while those between AED 187,500 and 375,000 can do so voluntarily.

What documents are required for VAT registration in Dubai?

To obtain VAT registration in Dubai, businesses need to provide copies of their trade license, passport details of owners/shareholders/managers, and financial records.

These documents must be submitted to the Federal Tax Authority (FTA) in order to complete the registration process. The FTA will then issue a VAT registration number, which must be used for all future transactions. Businesses must also ensure that they are protected.

What is the timeline for VAT registration in Dubai?

The VAT registration process in Dubai typically takes 2-3 weeks, with penalties for non-compliance. Penalties for non-compliance can be severe, so it is important to ensure that the process is completed in a timely manner.